Table of Content

- How to apply for the SSS business loan?

- What is an Target ETL Salary?

- LandBank OFW Loan

- Fintech Company Workhy Helps Entrepreneurs Start and Run Businesses Online

- How Much Do Cardiologists Earn in the Philippines?

- How Can You apply for Social Security System Loan (SSS loan) in the Philippines?

- Union Bank Housing Loan

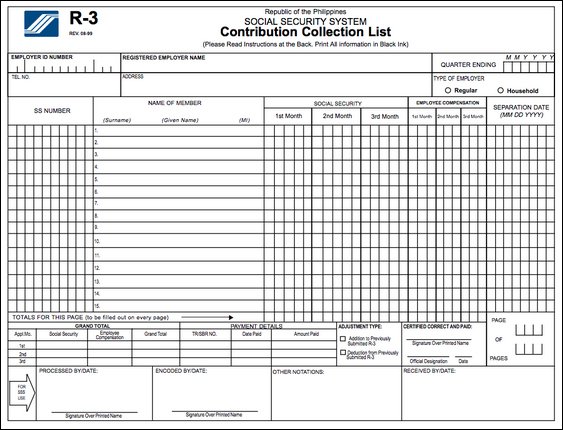

Members who wish to apply for a Salary Loan must fill out an application form and submit it to the nearest SSS branch office. The property subject of the loan must be occupied by the owner-borrower or his/her immediate family member upon purchase of the unit. The Social Security System Housing Loan was established to provide low-cost housing, home loan assumption, and house repair to working Filipinos. The Social Security System, a state-run social insurance program, issues an SSS Housing Loan. While SSS Housing Loans are not as prevalent as Pag-IBIG Housing Loans, they do have a number of advantages.

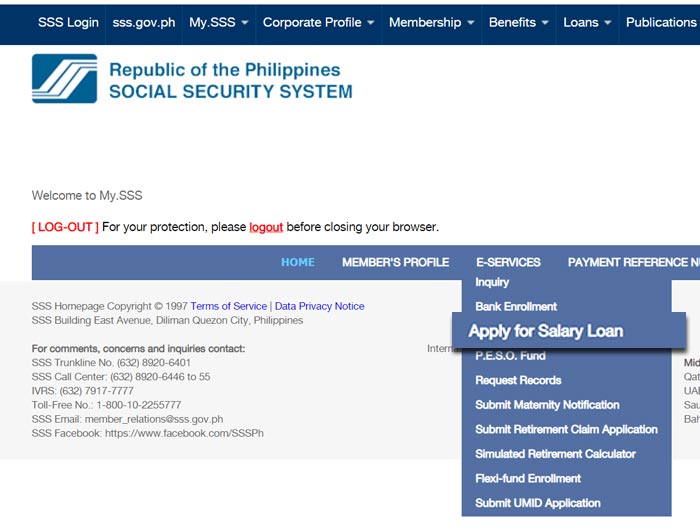

The process is almost the same as when viewing your contribution online. This is hassle-free since it will only take you less than 5 minutes to accomplish plus you do not need to leave your home. The Philippine Government started giving out SSS Salary loan to working employees who are in need of money for the short term. This loan is given to working people only as it ensures that they will return the money back soon.

How to apply for the SSS business loan?

The median salary in the Philippines is $1,857 per month. This means that half of all workers earn less than this amount and half earn more. The median is a good indicator of what is considered "average" pay in the Philippines. However, it is important to remember that there is a lot of variation in salaries, so some workers will earn much more or much less than the median. Member was not previously granted an SSS housing loan.

Therefore, the High-Density Housing Program was established by the SHFC . Their main objective is to give ISFs living in the National Capital Region safe, flood-free housing . There are plenty of different reasons why starting a business can be extremely challenging, but the most frequent and complicated is financing. If you are an SSS member and in need of financial assistance, you may apply for a Salary Loan at any SSS branch office near you.

What is an Target ETL Salary?

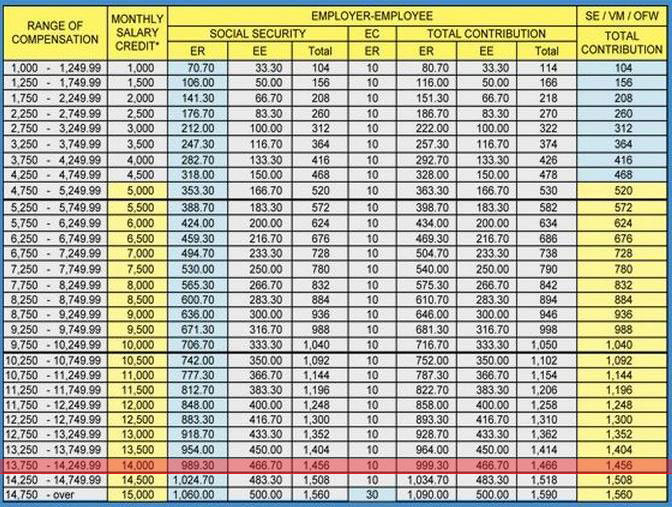

It also includes two furnished copies complete building plan approved by the official of the building. The minimum and maximum monthly salary credits will also be changed, according to Regino. The MSCs are the basis for calculating the SSS members’ monthly contributions. OFWs can also turn to PSBank if they wish to get a house or car loan through their Own Your Home and Drive Your Car OFW Loan products, respectively. Similar to other banks, OFWs must have worked abroad for at least two years with a household income of P30,000.

Another bank that offers Home Loans and Auto Loans to OFWs who have worked abroad for at least 2 years is Security Bank. Those who are earning P40,000 monthly can apply for Home Loans and those earning P50,000 monthly can apply for Auto Loans. Read about how to apply for Security Bank OFW loan here. Usually, loans are approved within five to seven days after applying. After signing the documents, you can receive the money within a couple of working days. To fit your budget, you can choose a loan term of 12, 18, 24, 30, or 36 months.

LandBank OFW Loan

An SSS Housing Loan is given out by the Social Security System, a government-run social insurance program. SSS housing loans have many benefits despite not being as common as Pag-IBIG housing loans. The charges are computed based on the fixed rate for a specific period. Metrobank Savings customers can avail of various types of loans. They can offer competitive rates and terms to help their families. Metrobank has created these loans that include OFWs as potential borrowers.

Applying for an SSS Business Loan in the Philippines is a great way to get your business up and running. With a business loan, you can rest easy knowing that you have the funds you need to start or grow your business. In this blog post, we will walk you through the process of applying for an SSS business loan in the Philippines, so you can get the funding you need to take your business to the next level. Fully or partially paying off your loan before it is due. Some banks will charge a penalty for this, so read the fine print. If your credit score is below the minimum required by the lender, you may also be rejected.

Fintech Company Workhy Helps Entrepreneurs Start and Run Businesses Online

However, a longer payment period is given to those in the extractive industries. The interest rate is reviewed monthly, depending on the PFI you’ve chosen. Because your interest is calculated based on what you owe on your loan each month, by paying a little bit extra each month, the interest in subsequent months will be lower. When you take out a housing loan in the Philippines, you enter into an agreement with the lender and promise to repay your loan over an agreed length of time (also known as the 'loan tenure' or ‘loan tenor’).

The spouse of an existing borrower may still qualify for an SSS housing loan if the loan of the existing borrower was obtained prior to the date of marriage and the loan is not delinquent. In addition, the approval of your application will be based on your current status in your employment. You have to submit the original and photocopy of your certificate of employment, proof of premium contribution, and compensation certification signed by the Human Resources Compensation and Benefits officer. Disclaimer - the information which is presented on Advanceloans.ph is provided for informative purposes only; all rates are subject to change based on only your personal circumstances. Active SSS member and has paid at least 24 months continuous contributions prior to application or at least 36 months total contributions.

Utilities, communications, warehousing, transportation, etc. Downloaded the app, apply and it take 5 min to get my cash. Billease is for you when you need to buy a new gudget but can't afford it, you may pay by parts. By clicking on "Apply" button I give my consent to the processing of my personal data and agree with 404 Projects LP's Privacy Policy and Terms of Use, also familiar with all the documents posted on Finanso®. Dennis Velasco is the CEO and Founder of Prosperna, an all-in-one eCommerce platform for Philippine businesses.

Member and spouse are updated in the payment of their other SSS loan, if any. WOMs refer to any association of workers in the private sector duly registered with the DOLE, the Securities and Exchange Commission, or the Cooperative Development Authority. It shall include any trade union center, federation, national union, local/chapter, or independent union as defined in Book V of the Labor Code. Duly filled and signed application of mortgagor with 1 x 1 picture of the applicant . A member can be qualified once a worker is currently under a contract from the Philippine Overseas Employment Authority and based abroad as authenticated by the respective embassy.

This is available to SSS active members who have never been approved for a repair and improvement loan from the SSS, and it is only for home renovations and improvement and not for the purchase of a home. You can also apply for such a loan if you plan on making major repairs if your home is deemed unsafe or if you are renovating it for expansion to increase its value. The constructed parts of a building must be permanently attached to the house. If your home needs finishing, a deep well, or a motor pump, you may also be eligible for a loan.

Through the sale ofNHMFC-acquired assets, they have developed a mechanism to assist these organizations in lending more money to prospective homeowners. If you are a first-time property buyer or have a tight budget, a Pag-IBIG loan will be more suitable. A bank loan might be theright housing loanfor you if you want to buy more expensive property. A cash loan granted to an employed member or a currently-paying self-employed or voluntary member. It is intended to meet the member’s short-term credit needs.

Certificate of Acceptance and Occupancy duly signed by the borrower if house is 100% complete at the time of loan filing . EastWest Bank is a leading bank in the Philippines that provides various banking services. Aside from deposits, you can also get a personal loan. There are two ways to get a personal loan from EastWest Bank. The first one is through the bank and the second one is online. PSBank offers financing for both new and used vehicles.

Although it must be emphasized that you do not need to be a depositor or member of a private bank to apply for the housing loans they offer, banks are more strict because of the higher loan amounts. Both of its goals are to assist housing loan borrowers in creating and funding their dream homes. Loan money via sss loan supports fast financial solutions by salary loan through a bank account after loan approval. Let’s find out the most reputable loan today through the content of this article.

No comments:

Post a Comment